As a real estate broker I often am present at the notary for the signing of the act of sale where the deed of ownership trades hands from seller to buyer. The dreaded Welcome Tax is one of the costs I always discuss with clients who are purchasing a home. It does sometimes still come as a shock to many buyers when the notary announces that the buyers will be responsible to pay thousands of dollars in Welcome Tax. Otherwise known as the Tax de Bienvenue, or more formally the Droit de Mutation / Duty on the Transfer of Immovables in Quebec.

Find out more about one of the largest taxes you might pay when you buy a home, the dreaded Welcome Tax!

In brief when a home is purchased by a buyer in Quebec, the municipality says “Welcome, now pay me!”, and when and if you sell your home next year and buy the home across the street, the city will again say “Welcome back! – even though you never left! Now pay me again!”.

Of course this is how it feels to the buyer. But this tax is really a duty that is charged by the municipality or city on the transfer of immovable property (including homes, duplexs, revenue properties, condos and land). Usually they are calculated on the value of the property and are payable by the buyer in one lump sum payment within 30 days of receipt by the new owner.

Why is it Called Welcome Tax?

There are a lot of myths where Welcome Tax comes from and why it’s known as Welcome Tax at all, as fitting a name as it is.

One popular and continually repeated (falsely) myth is as follows: The Quebec Welcome Tax was recommended in 1976 in Quebec by M. Jean Bienvenue (Welcome in French) minister in Robert Bourassa’s Liberals, after the province began to eliminate the transfer of some provincial sales tax revenues to the municipalities. The name stuck to its creator Jean Bienvenue however and it became commonly known as the Tax de Bienvenue or Welcome Tax.

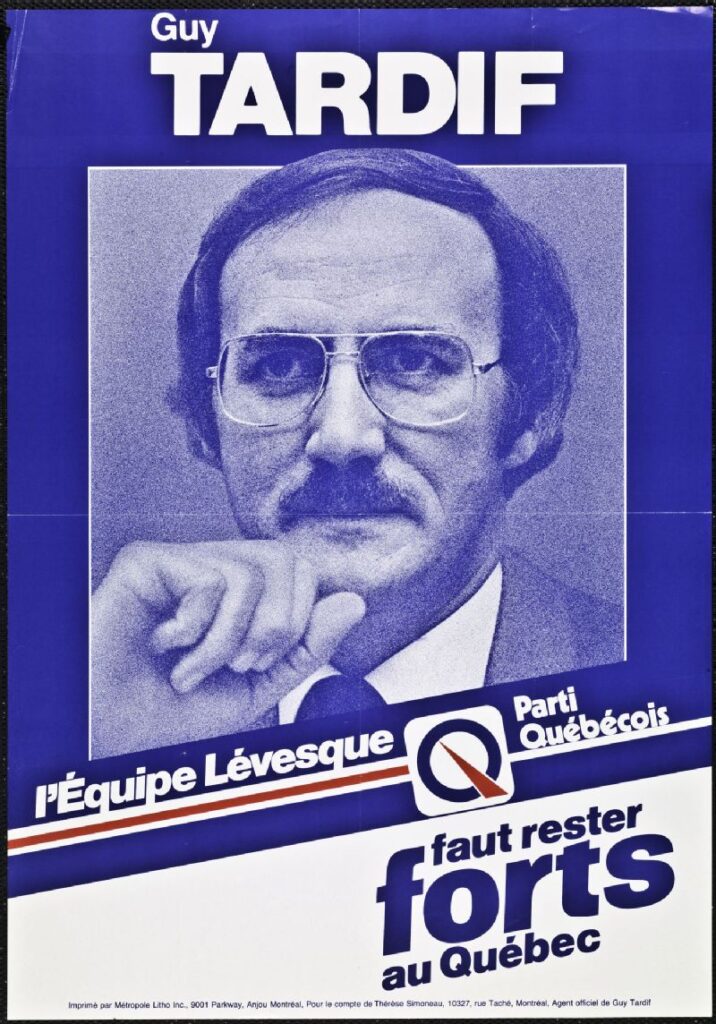

This legend is not the truth and M. Bienvenue had nothing to do with the Welcome tax. The truth is that when the PQ took power it was Guy Tardif in René Lévesque’s cabinet who brought it forward into law in 1976. At that time municipalities were given the option to levy taxes on the transfer of property instead of taking a portion of sales tax from the provincial government. This remained just an option until 1992, when the Welcome Tax became mandatory for all municipalities to collect on the transfer of immovable property in Quebec. There was no record of public figures or the government referring to it as a “Welcome Tax” until 1991.

How Do You Calculate the Welcome Tax When Buying a Home?

The government uses the highest value of the following:

- The amount that was actually paid for the property (excluding GST/QST).

- The amount shown on the deed of sale

- The market value of the property according to the government (the municipal evaluation of the property multiplied by a current comparative factor for the city of Montreal of 1.00 for 2023).

For the city City of Montreal:

That value is then calculated as follows:

| Value | Rate |

| $0 – $55,200 | 0.5% |

| $55,200 – $276,200 | 1% |

| $276,200 – $552,300 | 1.5% |

| $552,300 – $1,104,700 | 2% |

| $1,104,000 – $2,136,500 | 2.5% |

| $2,136,500 – $3,113,000 | 3.5% |

| $3,113,000 and more | 4% |

So if the taxable value is $600,000, it would be calculated:

$55,200 x 0.5% = $276

$221,000 x 1% = $2,210

$276,100 x 1.5% = $4,141.50

$47,700 x 2% $954

So the amount of transfer duties you’d pay is $7,581.50

Outside of Montreal, in the rest of Quebec, the welcome tax is calculated as follows:

| Value | Rate |

| $0 – $55,200 | 0.5% |

| $55,200 – $276,200 | 1% |

| More than $276,200 | 1.5% |

Municipalities may choose a rate of up to 3% for any amount above $500,000. The rate cannot be higher than 3% except for the city of Montreal.

Or use our handy complete home buying calculator which will give you a good indication of ALL the costs that are involved with buying a home as well as your monthly payments.

“The banks will not wrap the welcome tax into your mortgage as they often do with other municipal taxes.“

Usually within about 4-6 weeks of signing for your new property the municipality will send you an invoice in the mail that must be paid in full within 30 days. On top of all the expenses that good real estate brokers will discuss with new homeowners, this is a substantial cost that home buyers should save for before making a purchase. That’s right, you must save for it, as the banks will not wrap the welcome tax into your mortgage as they often do with other municipal taxes.

Can You Avoid Paying the Welcome Tax?

You can be exempted from paying welcome tax when:

- The property is being transferred from a direct ascendant or descendant. For example a father to a son, son to mother, etc.

- Transfer of ownership is between married or civil-union spouses.

- Newly divorced couples if the transfer is done within 30 days of the judgment.

- If the transfer is done by a natural person to a company (legal person) that is 90% owned by the same natural person.

- The value is less than $5,000.

Many first-time homebuyers are not aware that the Welcome Tax is charged each time you transfer property even if you move to a different home in the same municipality, you will be charged again.

As property values have increased, and municipal evaluations have also increased substantially over the years, the amount of Welcome Tax collected by municipalities has been tremendous.Now that you know where Welcome Tax came from and how to calculate it, I invite you contact me if you are thinking about buying a home, condo or revenue property and would like to know the full list of costs, benefits and programs available to you.